Annual Report and Accounts for the year ended 31 December 2023

Our Marketplace

In 2023 our three key markets were impacted by a slowing economy, stubbornly high inflation and rising interest rates. Whilst transaction volumes reduced in all our markets, they showed their resiliency with continued demand for our high-quality buildings and prime projects, albeit not at the same levels as previous years.

We still believe our markets are driven by long term trends such as retail moving online, population growth and the success of the main cities in terms of economic growth, education and health provision, leaving us with continued conviction that these markets will drive our growth and performance.

KEY LONG-TERM STRUCTURAL TRENDS

Our Focus Market

Market Overview

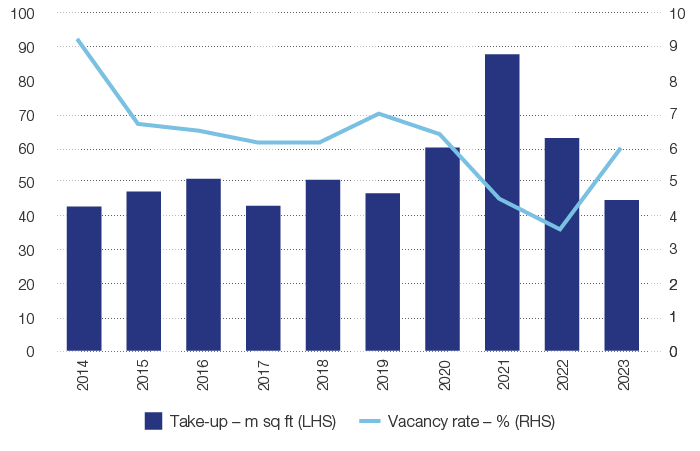

Warehouse take up has slowed over the last year, with volumes declining by c.30% to 44.5m sq ft in 2023 according to Gerald Eve. Whilst this is a reduction in demand from 2022, annual take up is now back in line with the pre-COVID levels of 2015-2019, after the pandemic sparked substantial demand for warehouses from online retailers due to a large spike in internet sales.

Gerald Eve believes that e-commerce remains a long term structural driver of demand for logistics space, with the emergence of other businesses that will also make an important contribution, such as green energy production and EVs as well as companies near shoring operations to improve supply chain resilience.

High street retailers are also looking to upgrade their logistics to more sustainable accommodation as well as increase their e-commerce offering.

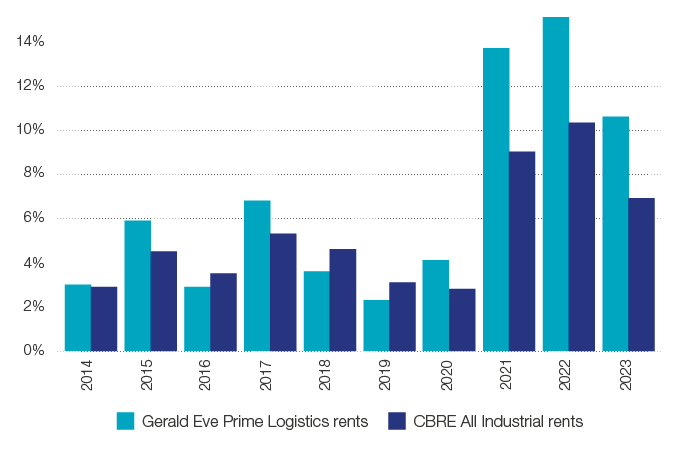

Industrial rental growth remained strong in 2023, with the sector delivering rental growth of 6.9% according to the CBRE UK Monthly Index, which was the highest within the commercial property sector. Industrial property capital values also increased by 1.4% against value declines in both retail and offices, reflecting the limited supply of high-quality warehouse space.

Warehouse take-up and availability

Annual rental growth

Market Overview

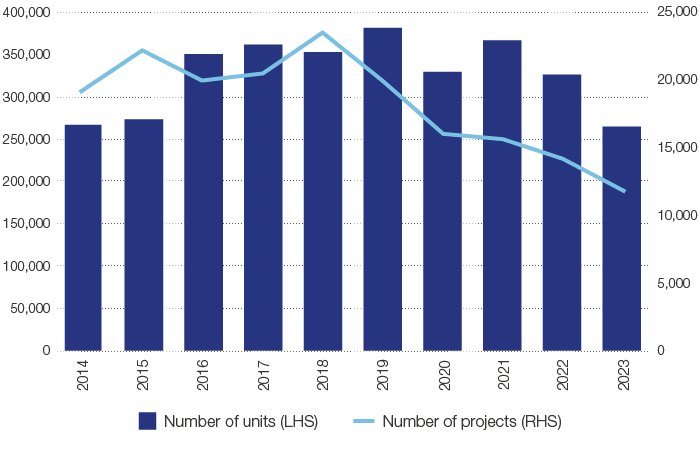

The latest housebuilding figures show that the Government has continued to fall short of its annual target to build 300,000 new homes in England, which reflects the delays and uncertainties caused by the planning system. According to Glenigan, in 2023 a total of 264,994 plots achieved planning permission, a decrease of 18% on the prior year. Whilst the Group has good levels of stock with planning permission to meet demand from housebuilders as the delays in achieving planning continue, the Government needs to carry out much-needed reform of the system. The complexity of the system not only affects the housing and commercial market, but also investment and productivity in the UK.

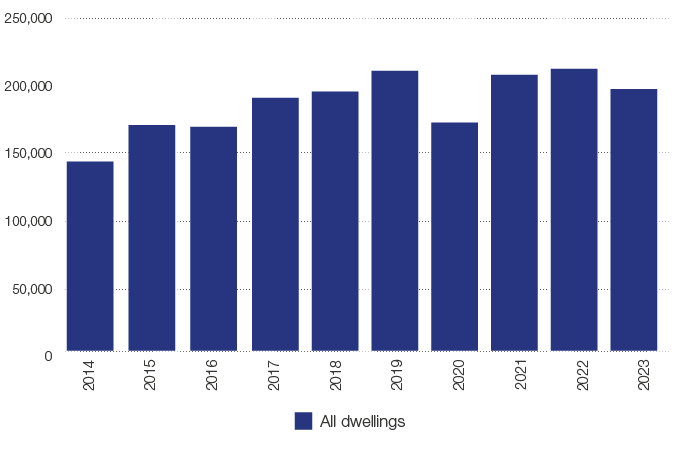

The UK housing market remained subdued during 2023 with house prices decreasing by 1.8% according to Nationwide. Lower volumes have been a symptom of the sustained rise in interest rates, which in turn increased mortgage rates resulting in affordability becoming more stretched for potential buyers. At the beginning of 2024, there have been encouraging signs that mortgage rates are edging down, which in turn should restore the confidence of home buyers.

Residential planning approvals in Great Britain

Housebuilding: Permanent units completed in Great Britain

Market Overview

The Urban Development market suffered the biggest disruption as a result of COVID. Cities saw a reduction in footfall as people chose to retreat from them and businesses supported homeworking reducing the demand for office space. Nonetheless, we are now seeing a reversal of these practices, with cites becoming more appealing to people again and an array of businesses either encouraging people to return to offices or making it mandatory to return full time.

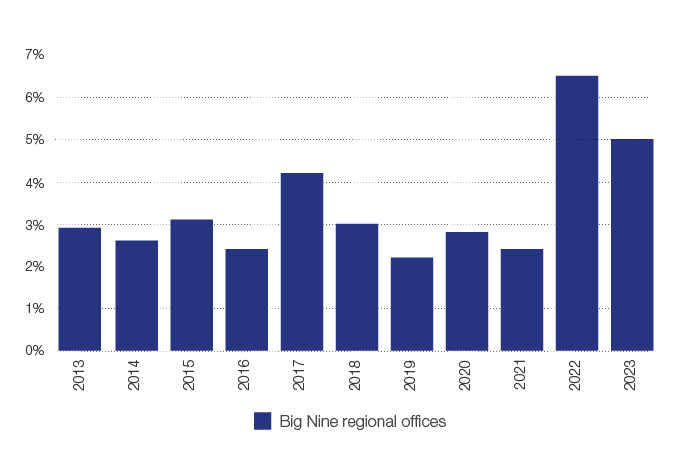

This is demonstrated as residential rents in 2023 saw a very healthy 8.3% rise according to ONS, supporting continued investor demand for BtR, with volumes remaining resilient at £4.3bn. Demand for prime offices in regional cities with strong ESG credentials has also picked up with rental growth of 5.0% in 2023.

Rental value growth (Dec 2013=100)

Office rental growth

Industrial & Logistics

Aliquas doluptur, corepre nobis eos eum estiis dolupta estiis dolore pa debis aut aut aut omnim ex et am esciis sum doluptas evenima ionseratquos pos pro quam faciist, saperum nimincit eos que eos mi, officiis eum es dolupti orendam, occus, ideliti si aceperi simporepre nost, omnis dolore quia ex est, inum rerum et, asperfe rehendi tempostorem.

XX.X%

GROWTH RATE PA

(2022:x%)

Residential

Aliquas doluptur, corepre nobis eos eum estiis dolupta estiis dolore pa debis aut aut aut omnim ex et am esciis sum doluptas evenima ionseratquos pos pro quam faciist, saperum nimincit eos que eos mi, officiis eum es dolupti orendam, occus, ideliti si aceperi simporepre nost, omnis dolore quia ex est, inum rerum et, asperfe rehendi tempostorem.

XX.X%

GROWTH RATE PA

(2022:x%)

Urban Development

Aliquas doluptur, corepre nobis eos eum estiis dolupta estiis dolore pa debis aut aut aut omnim ex et am esciis sum doluptas evenima ionseratquos pos pro quam faciist, saperum nimincit eos que eos mi, officiis eum es dolupti orendam, occus, ideliti si aceperi simporepre nost, omnis dolore quia ex est, inum rerum et, asperfe rehendi tempostorem.

XX.X%

GROWTH RATE PA

(2022:x%)