Annual Report and Accounts for the year ended 31 December 2023

Group strategic priorities

The Group set a medium-term strategy in 2021 to grow the size of the business through a 40% increase in capital employed to over £500m and a targeted focus on three key markets: Industrial & Logistics (I&L), Residential and Urban Development, while maintaining ROCE within a 10-15% range.

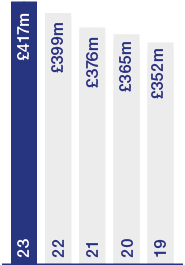

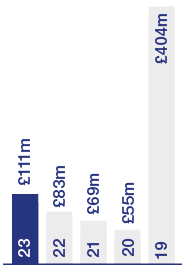

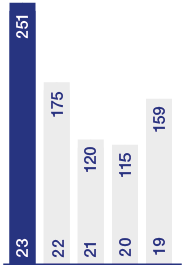

Our key metric of capital employed has risen to £417m (2022: £399m), and our ROCE at 9.9%, when rounded, was within our targeted range of 10-15%. Over the last two years we have delivered a ROCE of 10.8% p.a. which we believe to be a very credible performance given the decline in commercial property and land values of 22.1% and 8.6% respectively, from their mid-2022 peaks. We maintain our belief that we can achieve our main medium-term target of £500m capital employed, whilst continuing to generate attractive returns.

Key Strategic Pillars for 2023

Our strategy is shaped by four key strategic pillars and focuses on three long term markets:

Safety and Environment

We aim to be the safest place to work in our markets and be respectful to our environment

Growth

Grow capital employed to £500m by investing in our three key markets

Delivery

Adopt emerging working practices, investing and collaborating to deliver our operational targets

People

Open, progressive, high performing business governed by clear objectives which engages a diverse range of talent

Long-term Markets

Industrial & Logistics

Residential

Urban Development

Value Delivery

Property Development & Investment

Land Promotion

Home Building

Construction

Returns

Grow Capital Employed to over £500m + Target ROCE 10–15% +

Maintain a progressive dividend policy

Responsible Approach

People Strategy + ESG:

Risk

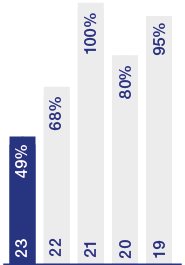

Optimum gearing of 10–20% + minimum 65% committed development

programme pre-let/pre-sold

OUR KEY PERFORMANCE INDICATORS

Key to Strategic Pillars

Key to Group Risks

1 Safety

2 Environmental & climate change

3 Economic

4 People & culture

5 Funding

6 Cyber

7 Pensions

8 Construction contracts

9 Property assets

10 Property development

11 Land sourcing

12 Land demand

13 Political

14 Housebuilding